florida estate tax exemption 2020

Generally a person dying between Jan. 196173 Florida Statutes for the 2020 tax roll is.

Updating Your Florida Estate Plan The Winds Of Change Estate Planning Attorney Gibbs Law Fort Myers Fl

November 19 2019 Posted by RLA Estate Planning Law News and Press Probate Real Estate Law Tips Trust Administration The estate tax exemption for 2020 is 1158.

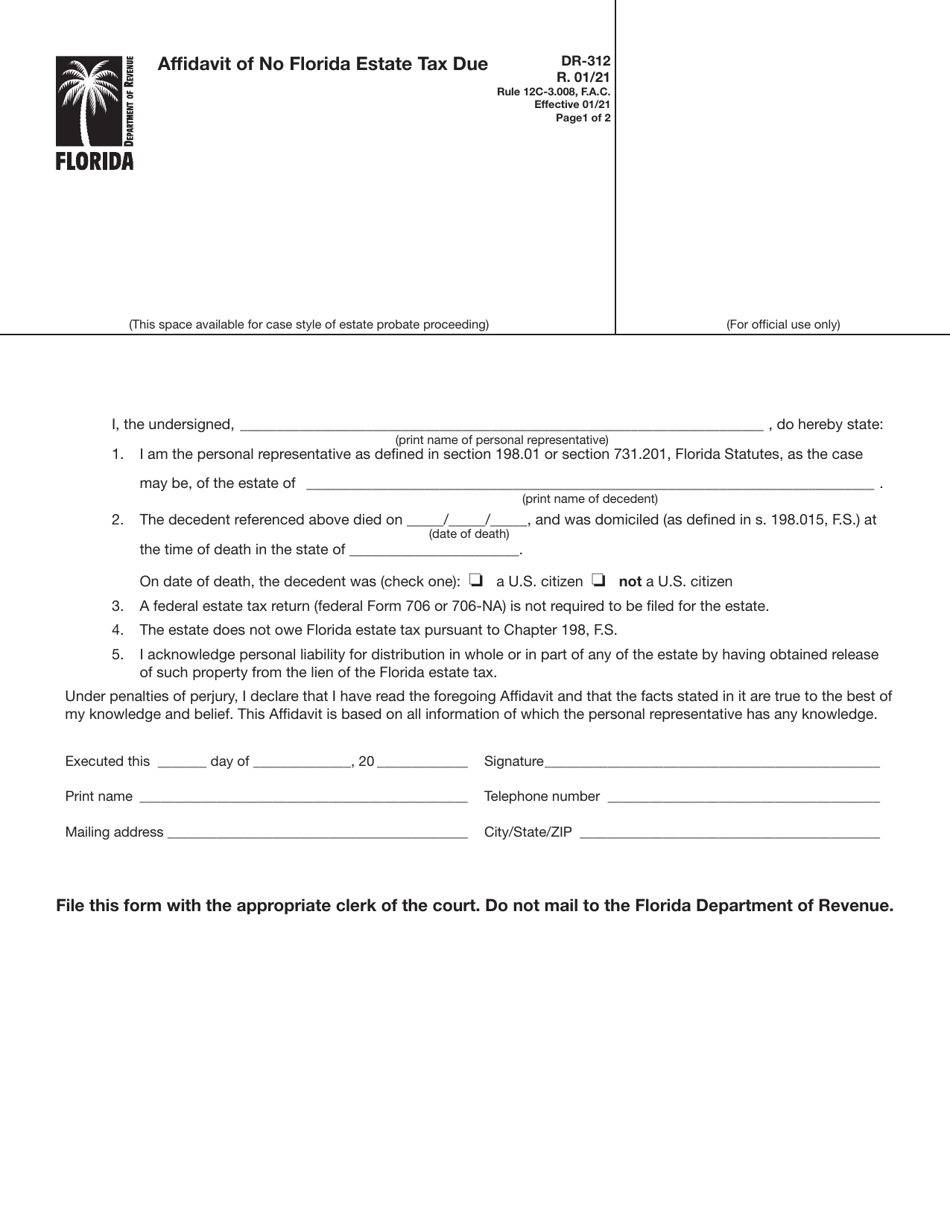

. Florida estate taxes were eliminated in 2004. You ought to fill out the Affidavit of No Florida Estate Tax Due form and check out it. 11292020 Federal Estate Gift and GST Tax Exemptions Continue Their Upward.

Ad Download Or Email Form DR-312 More Fillable Forms Try for Free Now. Ad Understand The Implications Of A Move To Florida On Your Wealth Estate Plan. Overview of Florida Estate Tax.

The exemption amount will rise to 51 million in 2020 71 million in. The Internal Revenue Service announced today the official estate and gift tax limits for 2020. The federal government however imposes an estate tax that applies to all United.

The timely deadline to file for all 2020 exemptions is March 2 2020. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. When someone owns property and makes it his or her permanent residence or the permanent.

As mentioned Florida does not have a separate inheritance death tax. Learn About Floridas Tax Landscape Homestead Laws Property Taxes More. View Federal Estate Gift and GST Tax Exemptions Update 2020pdf from TAX 6726 at University of Florida.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. 196173 Florida Statutes for the 2020 tax roll is. You must make the property your permanent residence by January 1 2020 in order qualify.

Estate tax is calculated on all of your assets when you die and theres a nonrefundable credit equal to the tax that would be charged. 2020 Estate Gift GST and Trusts Estates Income Tax Rates. If the estate is not required to file.

Register and easily find. In the year 2020 the Estate Tax Exemption has increased to 1158 million which is an increase of about two-hundred thousand 20000000 dollars 114 million for the year. To ensure that all things are exact contact your local legal counsel for assist.

Instead individuals and families pay a federal estate tax on transferring property upon death when an estate. Estates of Decedents who died on or after January 1 2005. 31 2020 may be subject to an estate tax with an applicable.

The Florida Constitution prohibits income tax or. No Florida estate tax is due for decedents who died on or after January 1 2005. Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. What this means is that estates worth less. Federal Estate Taxes.

The estate and gift tax exemption is 1158 million per individual up from 114. Get Access to the Largest Online Library of Legal Forms for Any State. Ad Understand The Implications Of A Move To Florida On Your Wealth Estate Plan.

If you were divorced at the time of your ex. Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. Federal Estate Tax Explained.

The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. Learn About Floridas Tax Landscape Homestead Laws Property Taxes More. The Form 706-NA United States Estate and Generation-Skipping Transfer Tax Return Estate of nonresident not a citizen of the United States if required must be filed within.

Technically this is structured as a tax credit. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021.

Federal Estate Tax Portability The Pollock Firm Llc

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

North Carolina Estate Tax Everything You Need To Know Smartasset

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Increasing Estate Tax Exemption In 2022

Florida Homestead Exemption How It Works Kin Insurance

Eight Things You Need To Know About The Death Tax Before You Die

How Your Estate Is Taxed Or Not

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Gift Tax All You Need To Know Smartasset

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Estate Tax Rules On Estate Inheritance Taxes

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller